|

| |

| |

Reprinted from the May 15, 1995, issue of

MODERN HEALTHCARE,

Copyright, Crain Communications Inc., 740 Rush, Chicago, IL 60611 All rights

reserved.

By Sandy Lutz

|

| More for-profit chains court public

hospitals |

Public hospitals and investor-owned hospital chains appear

to be reverse images of each other. One receives tax support; the other pays

taxes. One exists to treat patients who can’t pay for medical care; the

other focuses on generating a profit.

Yet, these images could blur as investor-owned chains seek out public

hospitals for their broadening networks.

“There is a lot of discussion going on between public hospitals and the

for-profits,” said David Hunter, president of the Hunter Group, a St.

Petersburg, Fla.-based consulting firm that specializes in hospital

management. “In some cases, the community will be better off; in some, it

would be better if a community not-for-profit steps up to the plate,” he

said.

But mixing for-profit chains and public hospitals can be explosive.

Witness the sparks this month in Tampa, Fla.

County-owned Tampa General Hospital is in the throes of accusations over

whether its board and former chief executive officer secretly tried to sell

it to the nation’s largest hospital company, Columbia/HCA Healthcare Corp.

Columbia and former Tampa General CEO David Bussone deny any secrecy, saying

their discussion were about managed-care contracts.

However, according to documents released last week, the always

acquisition-minded Columbia did propose a potential joint venture with the

public hospital, modeled after similar deals with private, not-for-profit

hospitals in Florida and Texas.

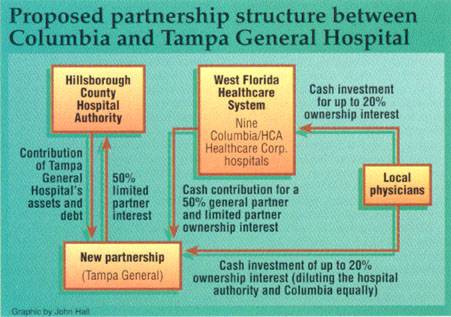

A letter from Columbia’s Florida President Dan Moen to Tampa General

chairman Frank Fleischer included a draft proposal of how a joint venture

would work (See chart).

Officials hoped the documents, which include letters exchanged by hospital

board members and Columbia officials, would help settle allegations that the

Nashville, Tenn.-based hospital chain and Bussone worked in secret.

“Every action we chose had prior approval by the (hospital) authority and is

documented in public record,” said Bussone, who now is administrator at

Columbia hospital in Plantation, Fla.

“Like many other non-taxpaying, public-supported facilities, (Tampa General)

is finding it very hard to compete in a managed-care world.” Bussone added.

Ironically, Bussone and two other public hospital CEOs made the cover of

MODERN HEALTHCARE’s Dec. 23/30, 1991, issue for their ability to turn a

profit amid rising charity-care burdens. The story featured Bussone; Ron

Anderson, M.D., of Parkland Memorial Hospital in Dallas; and James C. Pickle

or Erlanger Medical Center in Chattanooga, Tenn.

Favorable for-profits. Tampa General’s situation may not be unique.

With expected cuts in Medicaid and Medicare spending, public hospitals might

begin to look on for-profit chains with new favor.

In the past, investor-owned chains haven’t actively courted public

hospitals, especially ones in urban areas that have large indigent-care

loads. However, the hospital merger and acquisition business has reached

unprecedented levels in the past two years, making the sales of public

hospitals more of a possibility.

Recently, the county hospital in Santa Rosa, Calif., put out a request for

proposals, saying it needed to be part of a network (April 24, p. 92).

Rather than selling to a for-profit chain, public hospitals have been more

likely to privatize themselves by shifting their operations to a new

not-for-profit corporation. In the past, Tampa General had considered such a

privatization, what Bussone said board members often referred to as “the big

P”.

A handful of county and city-owned hospitals have been sold to for-profit

chains in the past. Many are managed by for-profit chains.

Still, the activity to acquire public hospitals seems to be on the rise.

Talking to Columbia. One recent example is Northwest Texas Healthcare

System, a public hospital district in Amarillo that has been talking to

Columbia about a possible purchase.

The hospital district now receives $8.2 million in annual tax support. “What

they have said is that they would eliminate the tax and live up to our

charity-care commitments,” said William Webster, the hospital’s president

and CEO. The hospital spent $21.2 million on charity care in 1994.

|

|

Despite recent discussion with Columbia, Northwest Texas will take time to

analyze all its options. Executive recently hired Nemzoff & Co., Nashville,

to conduct an analysis of the hospital’s options. |

Northwest Texas is profitable, but it’s a freestanding institution that

needs to be part of a managed-care network, Webster said. The hospital

reported net income of $13.8 million on revenues of $129 million in the

fiscal year ended Sept. 30, 1994.

Like most public hospitals in the state, Northwest Texas receives a

significant amount of Medicaid disproportionate-share money, a program that

may end soon if congressional Republicans succeed in moving to a block grant

program. In 1994, Northwest Texas received $12.2 million in

disproportionate-share reimbursement.

The sale of the hospital could open a wide-ranging public discussion in

Amarillo as it has in other locales. Because Northwest Texas is a public

hospital, a possible sale would require an open bidding process and,

perhaps, a voter referendum.

Throwing these matters open to voters can produce the same kind of political

rhetoric of other elections.

That’s the situation in Tarpon Springs, Fla., where a proposal to lease

city-owned Helen Ellis Memorial Hospital to Columbia has been the subject of

a spirited debate.

Unlike other city-owned hospitals, Helen Ellis is not operated by the city

and receives not tax support. It is operated by a private foundation, which

continues to want a deal with Columbia.

The original proposal was a 50-50 venture in which the foundation

contributed the hospital’s assets and Columbia contributed an outpatient

surgery center, home healthcare agency and $14 million in cash. The hospital

was valued at $50 million.

Last month, the city commissioners voted not to set a referendum on leasing

the city-owned facility to Columbia and instructed the hospital board to

look for other partners “with community-based missions” (April 24, p. 4)

One of the commission’s concerns is at the core of these deals: whether a

hospital can serve two masters, the community and shareholders.

“As a limited partner in a for-profit venture, the foundation will have an

incentive to act in the interests of the partnership, which may or may not

coincide with the city’s interests,” the commissioners said. In addition,

the city was worried that with Columbia in control, the city’s best

interests would not longer be paramount in the hospital’s operation.

“Columbia’s principal allegiance must necessarily be to its shareholders,”

commissioners added.

Despite the commission vote, Helen Ellis’ board recently decided to extend a

letter of intent with Columbia until the end of this month, hoping to work

out a deal the city will find agreeable.

“They’re concerned about the size of this company and their takeover

mentality.” Joseph Kiefer, the hospital’s administrator, said about city

officials’ concerns with Columbia.

He still sees Columbia as the best possible choice.

Last year, the board asked for proposals from possible suitors and received

five responses – all but one from investor-owned companies. The lone

not-for-profit was University Community Hospital in Tampa.

Small-town public hospitals haven’t been quite as hesitant to turn to

for-profit chains.

Last year, Troy, Ala., sold its 97-bed Edge Regional Medical Center to

Houston-based Community Health Systems for $14 million.

Twelve years earlier, when newly elected Mayor Jimmy Lunsford proposed

selling the hospital, “I was the biggest scoundrel in town,” he said.

But since then the hospital’s occupancy began ebbing, and efforts to recruit

doctors became harder and harder.

When he proposed selling it in 1994, there was “virtually 100% support” from

the town, he said. |

|